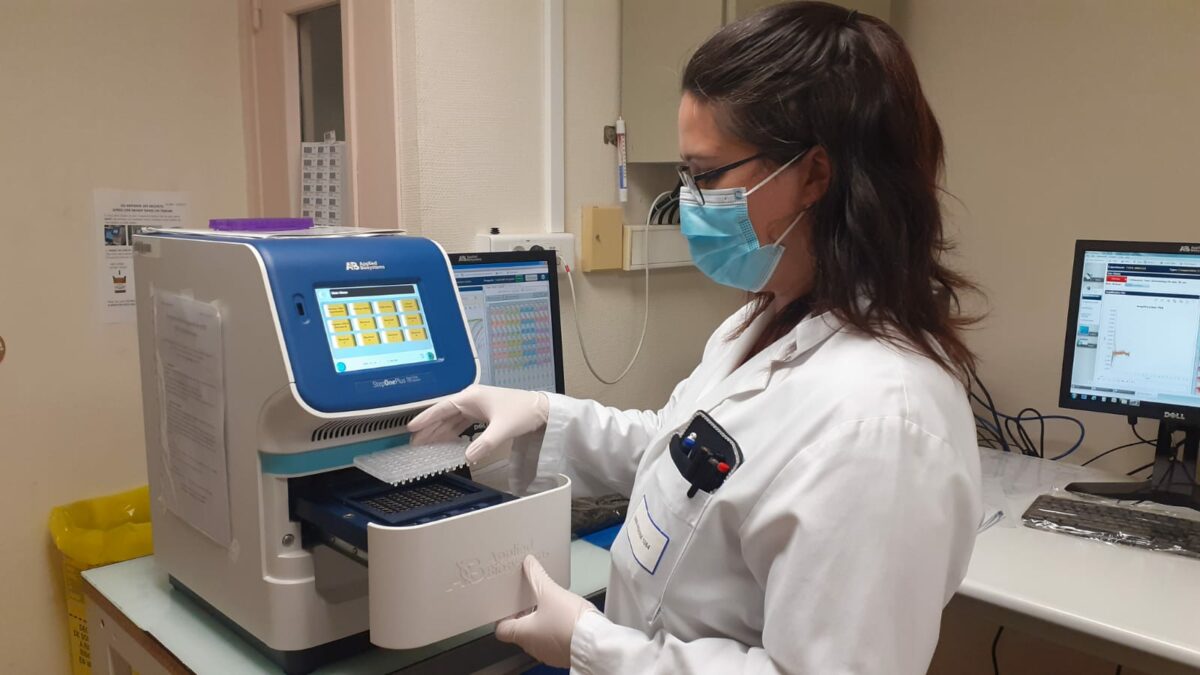

The investment to be used to develop its diagnostics solutions and contribute to improving the life of patients having received a kidney or lung transplant

BioMAdvanced Diagnostics, announces a fundraising of 1.7 million euros. The fundraising will allow BioMAdvanced Diagnostics to finalize the design of its first products and to start two clinical studies, one on the rejection of kidney transplants and the other on the lung.

The clinical study relating to the kidney rejection test will be carried out in partnership with the University Hospital of Nantes, the University Hospital of Oslo and the University Hospital of Barcelona with 300 transplanted patients and will allow the application for CE marking for a on-the-market expected in 2025.

Kidney transplantation represents about two thirds of transplants performed and the organs most often transplanted are the kidney, liver, heart and lungs. In 2021, more than 5,000 transplants took place in France. The number of transplants increases every year and France has set itself the goal of performing between 6,760 and 8,530 transplants by 2026, i.e. 40% more than today.

“Kidney transplants are on the increase all over the world and it is for kidney transplant recipients that we are going to develop our first product. Our objectives are to market it in 12 countries from 2026 to benefit 70 to 80% of patients. We have planned a second round of financing in 2024 to finalize the clinical studies and prepare our commercial presence in these 12 countries, and probably open a subsidiary in the United States.” says Frédéric Pette, co-founder and CEO of BioMAdvanced Diagnostics.

“BioMAdvanced Diagnostics has all the assets to become a key player in the service of personalized health for kidney and lung transplant recipients. We were seduced by the clarity of the leaders’ vision and are very happy to support the team in this project that is so decisive for public health.” adds Valérie Allain-Dupré, Director of Investments at Sodero Gestion.

The fundraising is led by Sodero Gestion, capital-investor of the West part of France on behalf of Pays de la Loire Development. Pays de la Loire Participations, Atlantique Vendée Innovation (Crédit Agricole Atlantique Vendée investment fund), SATT Ouest Valorisation and Bpifrance, notably via the French Tech Seed fund, also took part in the round table.

Press contract for BioMAdvanced Diagnostics :

Natacha Heurtault – nh@early-com.com – +33 6 12 23 58 60

About Sodero Gestion

Sodero Gestion is a major player in private equity in the West of France, with offices in Nantes, Rennes and Brest. Associated with the capital of a hundred regional companies, Sodero Gestion finances start-ups, SMEs and ETIs with equity in their development and transmission projects. Sodero contributes to the investment of regional savings in local businesses and support managers in their search for financial performance and in optimizing their positive impacts.

Sodero Gestion Press Contact: valerie.allain-dupre@soderogestion.fr

About Ouest Valorisation

Since 2012, the SATT has worked every day to be the bridge between public research and the socio-economic world. It simplifies and professionalizes the transfer of innovations from French academic research to businesses. The Ouest Valorisation team, attentive to public research laboratories in Brittany and Pays de la Loire and companies, offers a complete and tailor-made service offer. http://www.ouest-valorisation.fr/

Press contact for Ouest Valuation:

Thomas Labeyrie – thomas.labeyrie@ouest-valorisation.fr – +33 6 22 89 95 56

About Pays de la Loire Participations

The co-investment fund of the Pays de la Loire Region aims to support in the start-up and development phase VSEs and SMEs in the Loire region, through interventions between 100 K€ and 700 K€ in equity and quasi-funds own funds alongside private financial partners. To date, Pays de la Loire Participations participates in the capital of around sixty companies in Pays de la Loire. The management of this fund has been entrusted to the Capital Investissement company SIPAREX with a dedicated team in Nantes. For more information: https://plp-participations.fr/co-investment

Press contact for Pays de la Loire Participations:

Killian du Réau – k.dureau@siparex.com – + 33 6 63 32 17 21

About Atlantique Vendée Innovation (AVI), Crédit Agricole Atlantique Vendée investment fund

Created in January 2019 by Crédit Agricole Atlantique Vendée, the Atlantique Vendée Innovation investment fund supports innovative local companies in the fundraising phase. Endowed with €5 million, it invests in start-ups in the early stages or in development, with a project developing a product, use, service or technological innovation, all sectors of activity combined. After more than three years of activity, AVI now supports 16 companies. Atlantique Vendée Innovation is complementary to Village by CA and the banking solutions of the Regional Bank of Crédit Agricole Atlantique Vendée in order to offer local players a range of tools to make their projects a reality. Atlantic Vendée Innovation

Press Contacts for Atlantique Vendée Innovation (AVI):

Emmanuelle de Kerros – emmanuelle.dekerros@ca-atlantique-vendee.fr – +33 7 61 92 05 87 Véronique Hamel – veronique.hamel@ca-atlantique-vendee.fr – +33 6 22 42 15 12